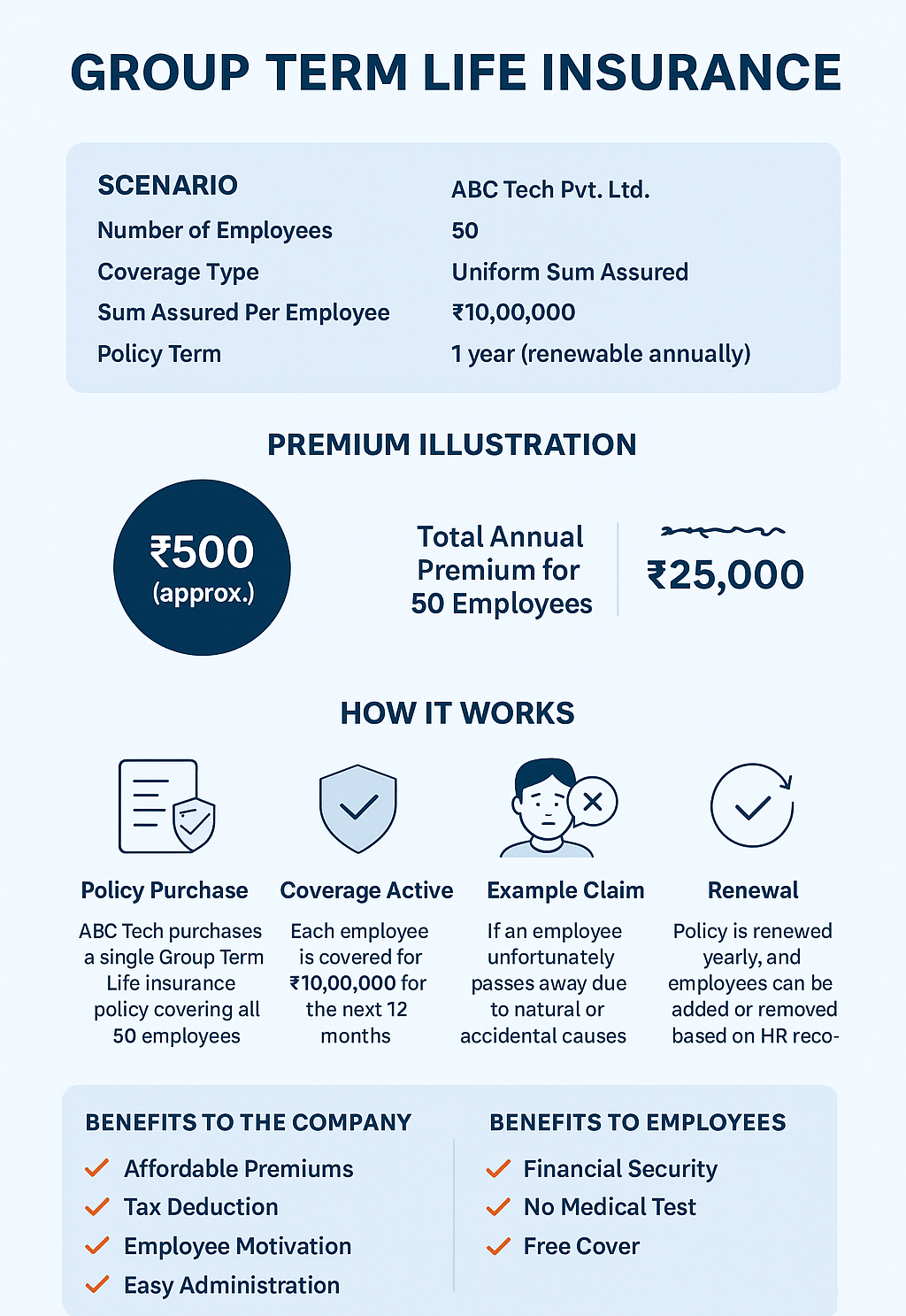

Group Term Life Insurance

Group Term Life Insurance is a type of life insurance policy that provides coverage to a group of people—usually employees of a company or members of an organization—under a single master policy. It is one of the most common employee benefits offered by employers.

Scenario

Company Name: ABC Tech Pvt. Ltd.

Number of Employees: 50

Coverage Type: Uniform Sum Assured

Sum Assured Per Employee: ₹10,00,000

Policy Term: 1 year (renewable annually)

How It Works

- Policy Purchase: ABC Tech purchases a single Group Term Life Insurance policy covering all 50 employees.

- Coverage Active: Each employee is covered for ₹10,00,000 for the next 12 months.

- Example Claim:

- If an employee unfortunately passes away due to natural or accidental causes.

- The insurer pays ₹10,00,000 as a lump sum to the nominee.

Premium Illustration

- Annual Premium per Employee: ₹500 (approx.)

- Total Annual Premium for 50 Employees: ₹25,000

Benefits to the Company

- Affordable Premiums: Low cost compared to individual policies.

- Tax Deduction: Premium can be claimed as a business expense.

- Employee Motivation: Enhances employee satisfaction and retention.

- Easy Administration: One master policy for all employees.

Key Features of Group Term Life Insurance:

Single Policy for the Entire Group

- One master contract covers all eligible employees or members.

Pure Protection Plan

- It provides only life cover — no savings or investment component.

- A lump-sum amount (Sum Assured) is paid to the nominee if the insured person passes away during the coverage period.

Affordable Coverage

- Premiums are much lower compared to individual term plans since the risk is spread over the group.

Employer Contribution

- Usually, the employer pays the premium (or shares it with employees as part of their benefits package).

Flexible Sum Assured

- The sum assured can be a fixed amount (e.g., ₹10 lakhs per employee) or linked to the employee’s salary (e.g., 2X or 3X annual CTC).

No Medical Check-up for Basic Cover

- Most group policies provide coverage without requiring employees to undergo medical tests (up to a certain sum assured limit).

Tax Benefits

- Employers can claim premiums paid as a business expense under Section 37(1) of the Income Tax Act.

- Nominees receive the death benefit tax-free under Section 10(10D).

Benefits for Employers

- Enhances employee satisfaction and loyalty.

- Provides financial security to employees’ families.

- Helps fulfill corporate social responsibility and attract talent.

Benefits for Employees

- Life cover at little or no cost.

- Peace of mind knowing their family is financially protected

- Option to enhance cover (voluntary top-up) at lower group rates.

- Financial Security: Family receives lump sum if insured employee passes away.

Disclaimer

Above example is purely for educational purpose. An individual should read all insurance related documents with terms and conditions before buying policy.